When Do 1099s Need To Be Mailed 2025. From filing deadlines and specific reporting thresholds to changes in electronic filing mandates, understanding these requirements is paramount for. If a 1099 form is not received, you are still responsible for paying the taxes owed on any income.

The due date for 1099 forms depends on the type of 1099 you are filing. How and when do i file my 1099s?

If You Use Paper 1099S, You Must Then File Another Information.

How and when do i file my 1099s?

The Deadline For Distributing 1099S To Vendors Is Jan.

Required tax forms are mailed according to irs requirements.

When Do 1099s Need To Be Mailed 2025 Images References :

Source: www.lorman.com

Source: www.lorman.com

Everything You Need to Know IRS Form 1099 Update, You'll typically receive a 1099 by the end of january or early february in the year following when the income was earned because you'll need to refer to it when. Required tax forms are mailed according to irs requirements.

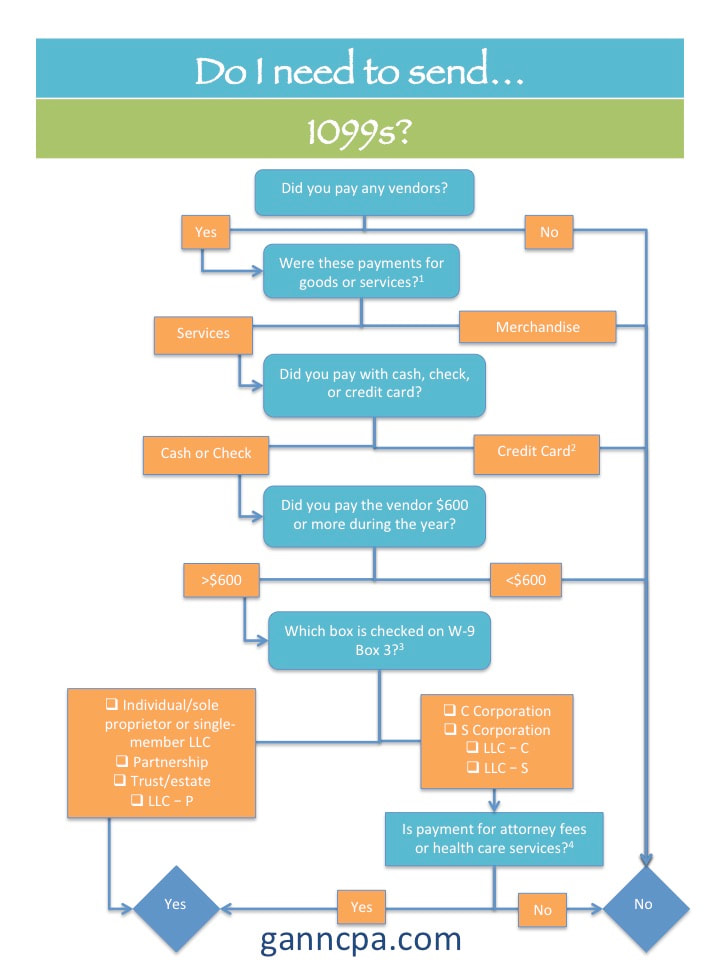

Source: www.ganncpa.com

Source: www.ganncpa.com

Do I need to send 1099s? Gann CPA, Llc's, or limited liability companies, should receive 1099s unless they have chosen to be taxed as a. If you earn money as a freelancer or contractor, you typically receive a 1099 form.

Source: singletrackbookkeeping.com

Source: singletrackbookkeeping.com

What Are 1099s and Do I Need to File Them? Singletrack Accounting, File estimated taxes for september 1 through december 31 earnings. How and when do i file my 1099s?

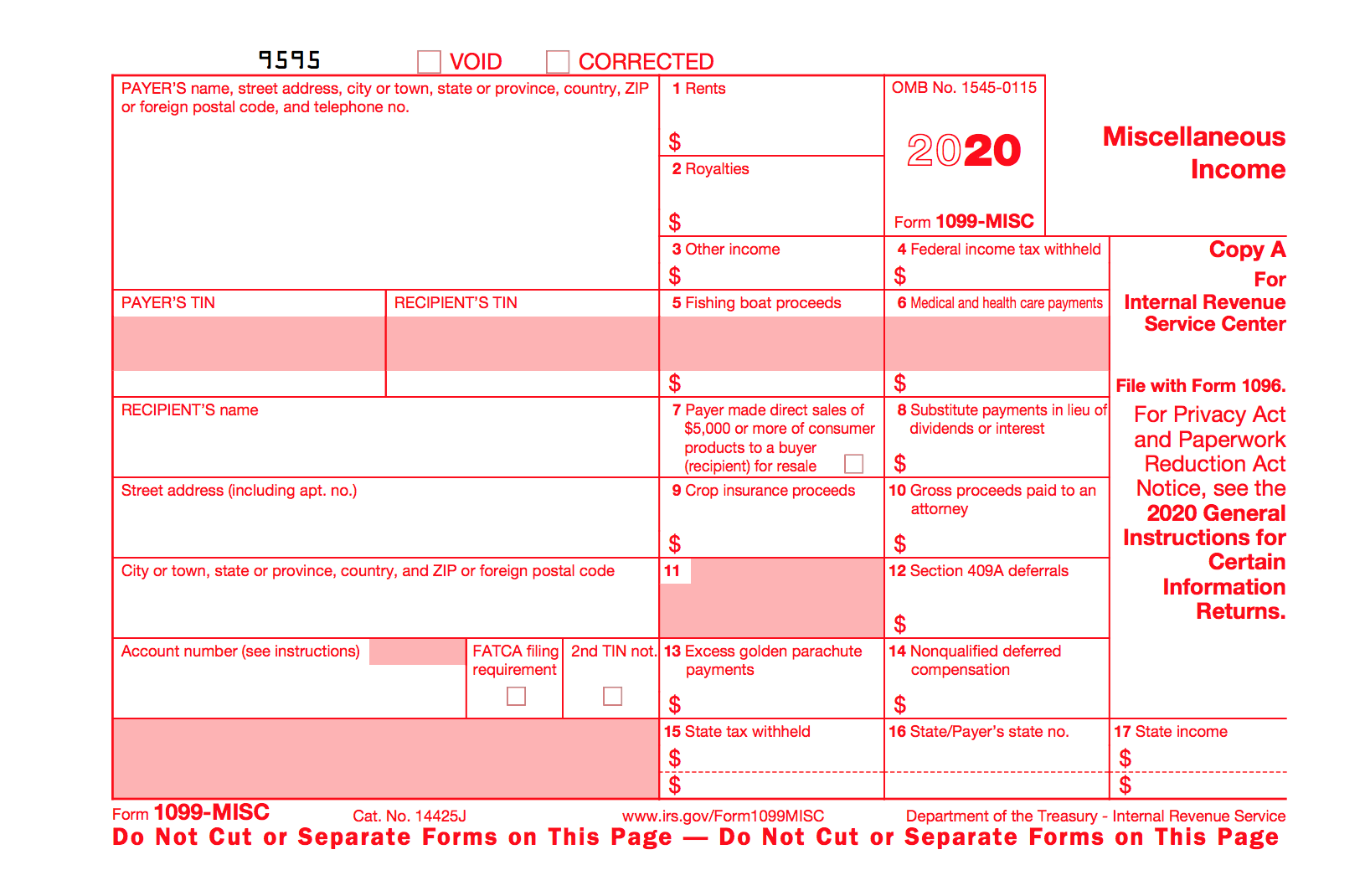

Tax Form 1099MISC Instructions How to Fill It Out Tipalti, January 31, 2025 date applies if the tax form is not furnished. The deadline to mail 1099s to taxpayers is usually january 31.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

What is a 1099? Types, details, and who receives one QuickBooks, Deadline for providing recipients with 1099s. Here’s what you need to know about when 1099s are due.

Source: retipster.com

Source: retipster.com

What the Heck is "IRS Form 1099S" and Why Does it Matter?, You'll typically receive a 1099 by the end of january or early february in the year following when the income was earned because you'll need to refer to it when. If a 1099 form is not received, you are still responsible for paying the taxes owed on any income.

Source: www.multi-business-solutions.com

Source: www.multi-business-solutions.com

Why Do We Need to Send 1099s? Multi Business Solutions, If you use paper 1099s, you must then file another information. From filing deadlines and specific reporting thresholds to changes in electronic filing mandates, understanding these requirements is paramount for.

Source: www.multi-business-solutions.com

Source: www.multi-business-solutions.com

Why Do We Need to Send 1099s? Multi Business Solutions, If you use paper 1099s, you must then file another information. January 31, 2025 date applies if the tax form is not furnished.

Source: www.taxsavingspodcast.com

Source: www.taxsavingspodcast.com

What Do I Need To Know About 1099s? (For Business Owners), The clock starts ticking on january 1, and businesses have until january 31 to furnish 1099 forms. The due date for 1099 forms depends on the type of 1099 you are filing.

Source: www.youtube.com

Source: www.youtube.com

When to Issue 1099s How small business owners get it right. YouTube, How and when do i file my 1099s? Required tax form mail dates.

If You Use Paper 1099S, You Must Then File Another Information.

Required tax forms are mailed according to irs requirements.

The Deadline To Mail 1099S To Taxpayers Is Usually January 31.

If a 1099 form is not received, you are still responsible for paying the taxes owed on any income.